With the US stock market making a tremendous comeback since the COVID bottom a year ago and stocks trading at pre-COVID levels, many are questions whether the stock market still have room to run.

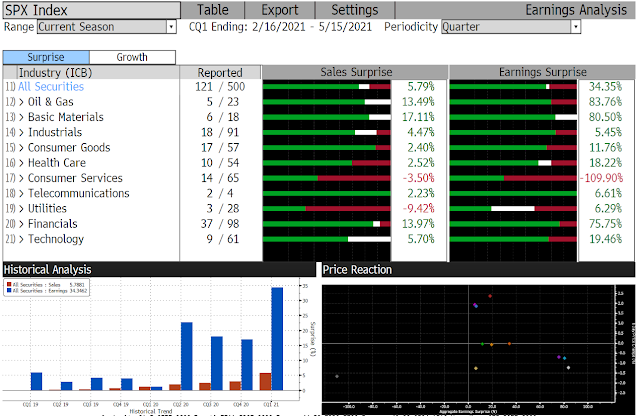

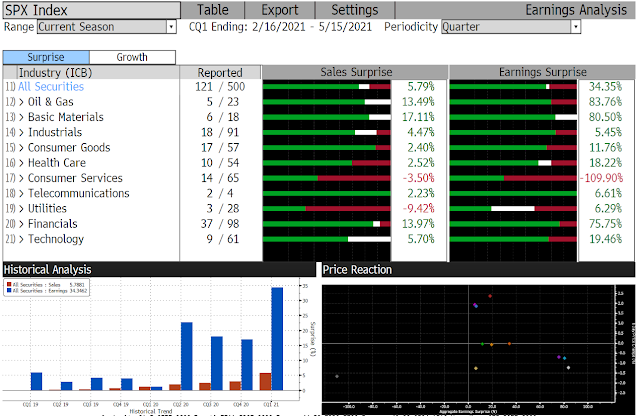

The latest quarterly earnings may have given us some clues: while expectation was high coming into the quarter with consensus estimating ~25% aggregate earnings growth y/y, companies have been meeting the high bar so far. Out of the S&P 500 companies that have reported so far, 80%+ of the companies have beaten consensus EPS expectations. In aggregate, companies are reporting earnings that are 20%+ above expectations. Hence, the bull argument is that we are still in the early innings of a strong economic recovery, and the companies have successfully emerged from the COVID crisis bigger, stronger, and better.

That said, the (muted) price reaction indicate to us that a big part of the earnings beats are already priced in. Look -- for example -- at Coca Cola (KO), Kimberly Clark (KMB), Procter & Gamble (PG), which have missed their bottom line estimates, casting doubts on whether companies can pass on the cost-inflation to end customers. Another example would be Netflix (NFLX), which has disappointed investors on subscriber growth (link: Bloomberg - Netflix Falls after Pandemic Boom reverses to Rare Weakness), casting doubts on whether the pandemic-driven growth to some of the tech companies are sustainable at all.

Notably this week, the Bank of Canada announced its plan to slow asset purchases, essentially beginning to taper (link: Bloomberg - Bank of Canada becomes first to signal exit from stimulus). It should be noted that the Bank of Canada is the first major central bank to do so, but we can assume that as time passes and as more positive economic data points come out, the FED and the ECB will also see increasing pressure to exit stimulus. That would be another headwind to the equity market, in additional to the weakening company fundamentals that we discussed above.

Net-net, we can protect ourselves from potential downside by being cautious, adhering to companies with strong fundamentals, staying away from the more "speculative" investments (SPACs, etc.?), and making sure we have some dry powder ready.