Hang Seng Index (HSI) has been recovering from the 28,000 level to the 29,000 level. While short term capital market directions is very difficult to predict, there seems to be a number of tailwinds in favor of the Hong Kong equity market.

Perhaps it is best to visualize it with a few charts: Historically, there is a decent correlation between CSI 300 and HSI (>50% correlation over the past 5 years). Now as the A share market is gaining some traction, the Hong Kong equity market is also likely to the supported.

This is evidenced in the inflection in Southbound buying, where Southbound turnover appears to be stabilizing and inflecting.

Meanwhile, borrowing cost is at record low in Hong Kong, supporting potential “re-leverage” in the stock market.

On the US front, President Joe Biden has seek to roughly double capital gain tax to ~40% of wealthy individuals. This would be the highest tax rate on investment gain (if passed through Congress), mostly paid by wealthy individuals in the US. While some equity research houses suggest there has been no historical correlation between capital gain tax and stock market performance, this would still potentially spark a re-allocation to overseas markets (including Hong Kong stock market).

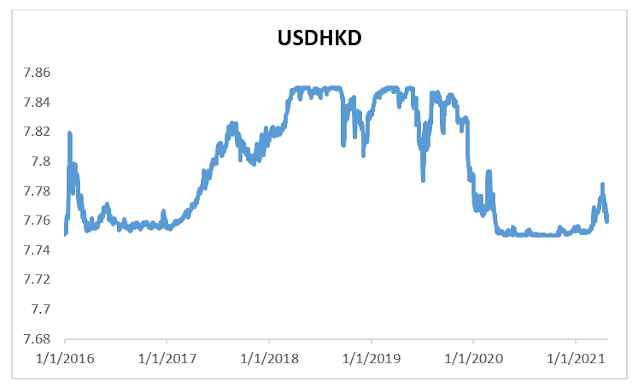

Finally, according to back-testing done by some reputed investment research providers, historically it could be an alpha gaining strategy to buy into the Hong Kong market when USDHKD is weak (defined as USDHKD<7.76, which is approximately where USDHKD is trading at right now).

沒有留言:

發佈留言